Recipe for a Criminal Fraud

Ingredients:

- One Member of the Irish Diaspora with a Factory.

- One Empty IDA Factory

- One Irish Ambassador

- One badly administered EU Fund

- A complete lack of ethical standards

Method:

In preparing this dish timing is of the utmost importance. First you invite the Member of the Irish Diaspora to dinner at their local Irish Ambassador’s residence and encourage him/her to “do the right thing” and move their factory to Ireland. Toss in lots of green flag and so on. You offer him/her one of your many empty factories “rent free” for say 4 years followed by an option to purchase. You can also toss in a few handfuls of EU funds in the form of training grants and so on just to spice it up a bit. It is now very important to wait until the factory is in Ireland before anything is signed. This will involve seasoning in the form of charm, a little guile and plenty of reassurance. When the factory is relocated you then tell them that “rent free” is not in fact rent free and that you will charge rent but that the rent will be grant aided. You should set the rent as high as possible. The member of the Irish Diaspora will not complain too much as they will not have to pay it and they have already moved and so are not in a position to argue. You can then start invoicing rent and issuing grants for the rent each month. The nice thing about this dish is that you can now tell the EU that the factory is an Irish indigenous start up and recoup most of the grant from EU funds and as the rest of the grant is from you to you there is no problem there. Obviously the higher the rent the better. Presto your empty factory has now become a “nice little earner.”

But it does not end there, this is a very versatile dish. After the “rent free” period you can refuse to sell the building to the business for some reason or other and if they then want to leave Ireland you can say that they have to repay the rent to you. In this way you can be paid twice!

The versatility does not end there. The member of the Diaspora may now be trapped so you can perhaps pressure them to allow some of your friends to invest in the business. You can set this up as a BES tax scam so your friends can also use their investment to avoid paying their taxes. This is another example of how this versatile and easily prepared dish can be served over and over.

If at some point the member of the Irish Diaspora cottons on to how the dish was structured you simply continue to insist that it was an Irish indigenous project and you did nothing wrong. It is absolutely vital to stick to this story, come what may, because otherwise you may be charged with a criminal fraud and end up in prison.

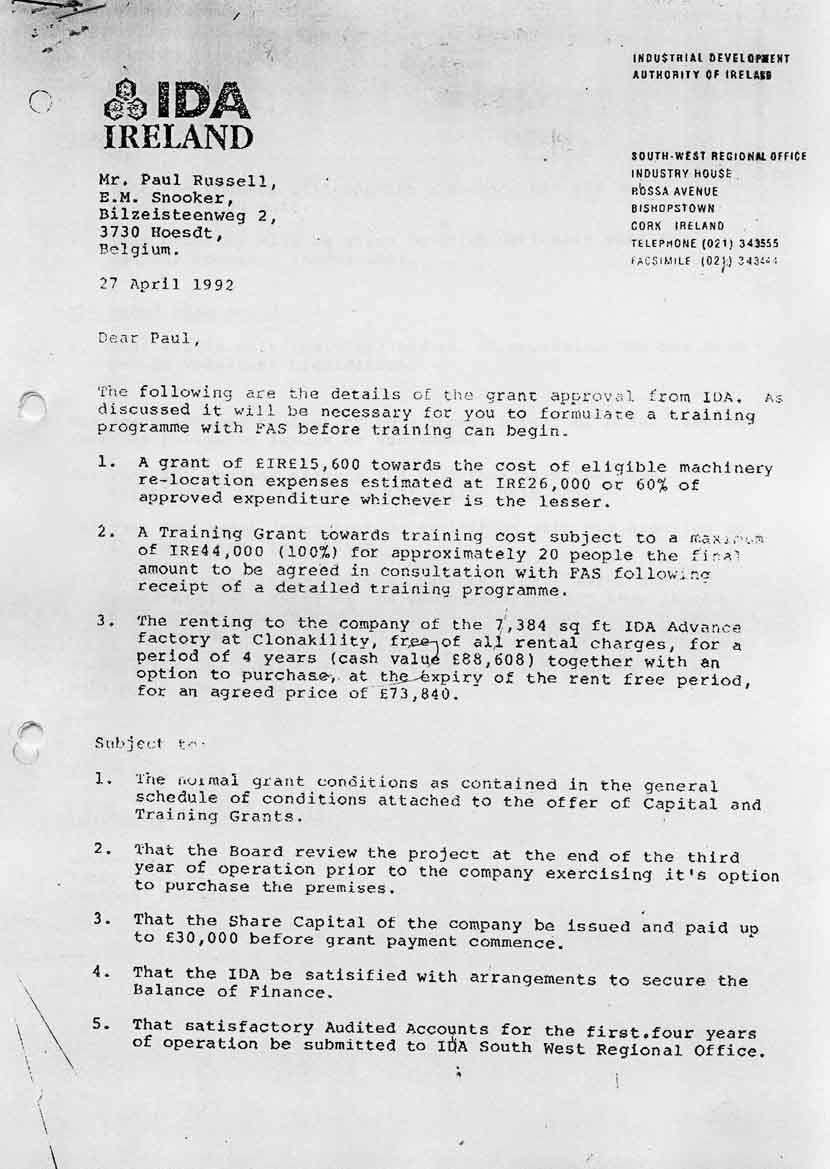

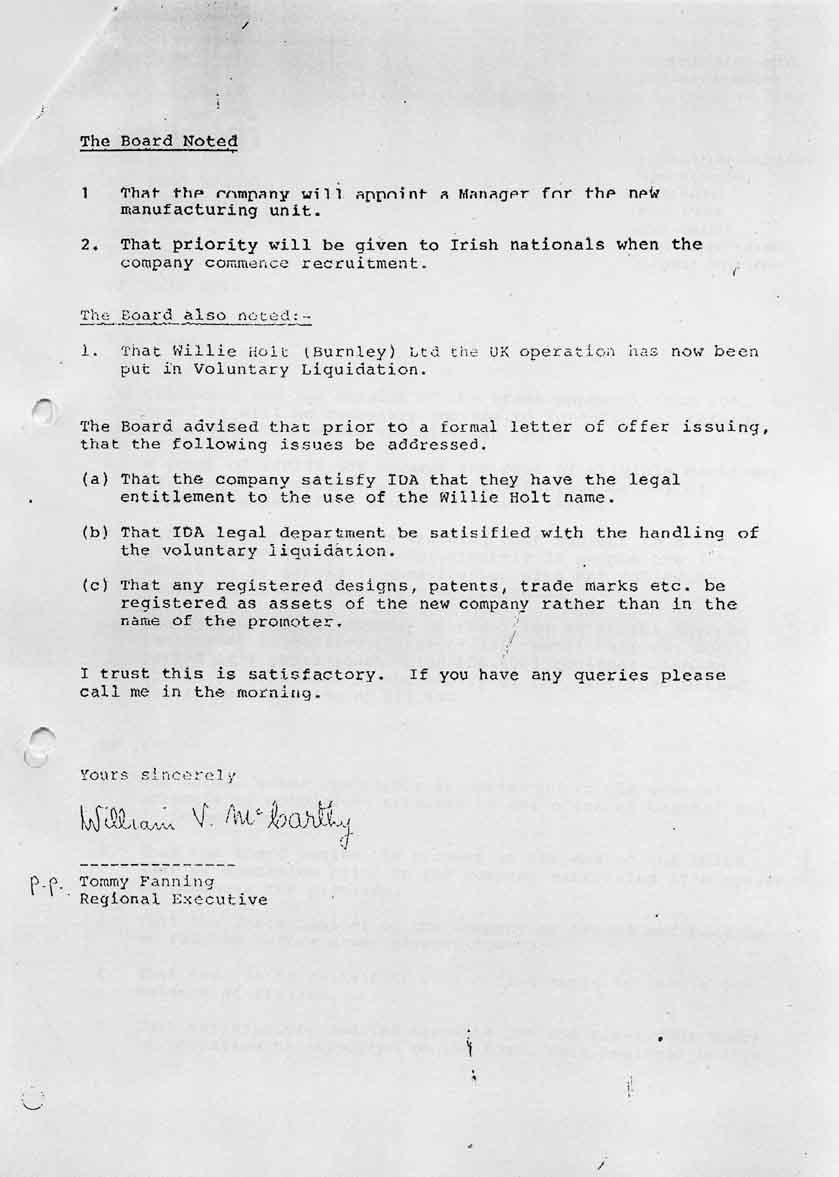

The Incentive Package that brought the company from England to Ireland |

|

So is Mr Barry O'Leary the CEO of IDA Ireland covering up the IDA role in a criminal fraud? |

These sample documents and the tape recording can be studied in context in the Willie Holt (Burnley) Ltd story on this website. If you are a member of the Irish Diaspora and you are considering moving your business to Ireland and your business is an SME it is absolutely vital that you study the Willie Holt (Burnley) Ltd story and listen to the tape recordings included in this story to get a feel for what it is like should you get involved with these organisations.