Overall Strategic Errors.

Overall Strategic Errors.

The reader should note that we are talking about a company with a track record of successful innovation, with a 10% profitability on turnover, with 18 months of orders in hand and customers who were prepared to pay for the goods prior to their manufacture. I believe most manufactures would regard this as a exceptionally good situation!

Yet again and again we can read from Forbairt’s correspondence about our dire financial situation! Leaving aside the fact that they themselves were responsible for any instability, financial, legal or otherwise. Looking back at the situation and listening to the tapes of conversations it is clear that our approach to our dealings with these agencies was entirely wrong in a number of ways.

Being Honest and Friendly.

When you are running a business uncertainties go with the territory. Throughout these discussions we were open about the uncertainties we faced. This was a mistake. Civil Servants who live in a situation where their pay and pension is guaranteed view any uncertainties as very serious. We should not have been so open with these people. Being friendly and civil was also a mistake “I know it is not your fault Kevin” and “I know it is not your fault Farnham” was not a good approach. These abusive gentlemen held a sword over my head and I felt that for the sake of our family and employees I had to maintain a civil discourse. With hindsight this was a mistake and only served to encourage the abuse.

Talking about Job Losses.

We repeatedly stated the urgency of them moving on the situation. We warned them that the jobs we had created were being jeopardized by their failure to honour their agreements. In fact this only served to reinforce the atmosphere of crisis that had evolved.

In fact by winding them up we were probably reinforcing their attitude. We were in fact inadvertently giving them an excuse. Winding them up about job losses was also a waste of time. The Celtic Bubble was well underway and there was now a labor shortage. This was not 1992 it was 1996 and there was plenty of jobs in construction.

They simply did not care about the jobs. Proof of this arrived the following summer when the new Minister Ms. Harney introduced the HLCL policy and the IDA enthusiastically embarked on an all out assault on Irish manufacturing.

We should not have talked to them at all.

If we were in fact being used as a means to embezzle EU funds then they were motivated by the fact that we were a source of income for the State Agencies and the longer they strung us along the more money their organizations stood to embezzle, both from EU funds and from us. If this is the case then talking to them at all was a waste of time.

If this is the case, then they were always going to go for the money. This would explain why when we refused to cooperate with the “we’ll give you another year rent free Paul it’s a very generous offer” proposal they responded by demanding rent, upping the price for the factory and removing the expansion land beside the factory from the offer. Was it that they simply ran out of time to put the paperwork in place to get the funds from the EU and so they compensated by getting more money for less from us?

This is in fact a very strong argument that a fraud , was indeed going on and that talking to these people was counterproductive and a complete waste of management time. We should have simply taken immediate legal action even if it risked breaking the company.

Our Failure to Involve OLAF and the Police.

When we received the letter of April 10, 1997 were Mr. Sherry outlines the level of EU funds involved we should have immediately brought the matter to the attention of the Police and OLAF. Missing this opportunity was a grave error.

Talking about the Ecommerce Software.

Talking to them about the Internet software in 1996 and its business potential was also a major mistake as it only served to convince them that we were in need of psychiatric evaluation.

Currency Catastrophe

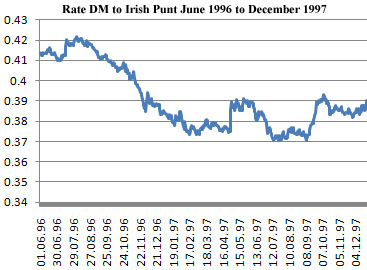

In May 1996 we got an ADP order worth 3,000,000DM. Given that we now know how many DM we would be getting over the next 18 months we could now buy the Irish Punts we needed and so avoid any currency fluctuations. However we did have some insurance at least on the short term and we did not want to give this up. This insurance was that one possible way to get out of what we saw as an IDA trap would be to sell the order to an overseas competitor.

So we made the fatal decision not to book our Punts with the Bank. The Punt was engaged to be married to the DM but had a last fling with Sterling and shadowed Sterling’s 10% rise against the DM that year. The graph on the right shows the value of the DM in Irish Punts over the period of the order. So in trying to keep the escape route open for the sake of our children we had in fact destroyed our profit on the order. As parents the decision to fight the Irish State agencies was looking increasingly irresponsible with every passing day.

By now the kids were on first name terms with the Polish staff on the Swansea Cork ferry. While my wife was managing our snooker club in Belgium, and the installations and service business, I was imprisoned in Ireland. We never imagined that they would keep up the abuse until the end of 1997. This situation developed over the time in the background and put us under ever increasing psychological pressure. We were in hell on earth.

The Question Of Solvency.

Talking to them on their own terms was a very big mistake. Mr. Sherry continuously harped on that we were “insolvent”. He based this assessment on the Cole report. We were not insolvent and indeed it would be difficult to be so in a situation where the company enjoyed the support of its Bank and was being paid in advance of manufacture for its products. Now a company that has a big loan from a lender might not have the assets to pay that off straight away. That company might appear to be insolvent but wouldn't be because the loan isn't repayable at once. So it could still pay its debts as they fall due. In our case, being pre-paid for the orders certainly helped with our cash flow in a practical sense, but until the order is filled and can be recognized as a sale, that money would be considered a liability, so that our balance sheet would not look any better than before the prepayment. That would be an accounting convention but it understates the health of the company's position because they are treating money as a liability when in fact it is not payable to anyone (unless the order is messed up). The money would only be treated as no longer a liability when the sale is recognized.

Generally speaking the view would be that the word "insolvent" should not be used in a situation where the balance sheet shows an excess of liabilities over assets because that fails to take into account all the relevant factors e.g. the support of lenders. That is where you'd get back to the term "unable to pay its debts as they fall due". If the latter was really true, perhaps the word "insolvent" might be used in a fairly accurate sense, but not where the balance sheet is looked at in isolation from the cash flow etc.

As directors we were and still are of the opinion that one is entitled to consider that the purpose of the legislation was to protect the interests of our creditors. If this is correct, and it is certainly logical, then the interpretation of the word "solvent" should be the "ability to pay debts or liabilities as they fall due". Our position was that irrespective of the question whether assets do in fact exceed liabilities, it is ability to pay promptly from day to day which is the underlying consideration which should form the basis of assessing solvency without the Directors having to consider whether, if they were to put to a realization of their assets, these would meet their liabilities.

An accountant which, I understand Mr. Sherry is, should arrive at a decision with regard to solvency on the basis that all liabilities will be met as they fall due rather than on the basis that assets may exceed liabilities. In my conversations with Mr. Sherry I discussed the matter of solvency on his terms accepting that that Mr. Sherrie’s fire sale solvency definition was his test to allow the sale. This was a serious mistake. The question then arises why would Mr. Sherry, a qualified accountant, take the fire sale approach. What was the motivation? I will leave the answer to this question to the reader.

Of course the ultimate irony in all this is that the directors had worked for 4 years in the belief that IDA would do as they had promised and the fact that they did not was the source of any weakness. In fact Mr. Sherry and his colleagues had put a hole in the boat and were now complaining about the leak.

Please take the time to answer our Poll on the right hand side of this page and if you have any comments use the “comments” link at the bottom of this page.